Why Parents Need To Talk More About Money

Expert help and advice

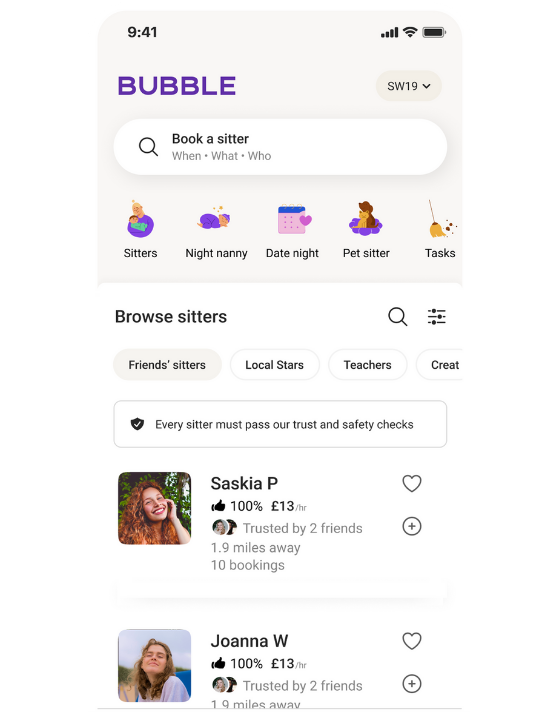

Find great childcare

Download the Bubble app to find and book childcare in as little as 30 minutes.

Download the Bubble app

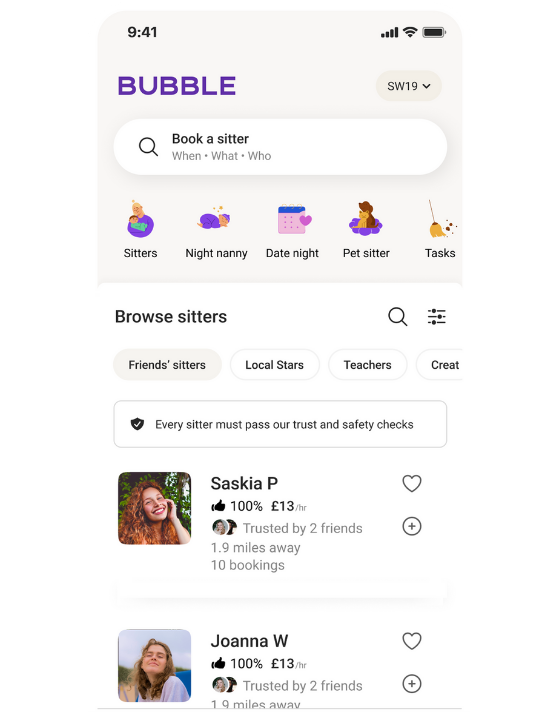

Find great childcare

Download the Bubble app to find and book childcare in as little as 30 minutes.

Download the Bubble app